Businesses today want to save money and work better, and payments are a big place to do that. According to Ilya Mikin, CEO of Wallid.co,Pay-by-Bank, using open banking, can help cut payment costs a lot. Ilya explains how it does this and why businesses should think about using it.

What is Pay-by-Bank?

Pay-by-Bank is a payment method that uses open banking technology. It allows customers to pay directly from their bank accounts. There's no need for credit cards or third-party payment services. Instead, customers simply authorize payments using their existing online banking credentials.

This direct approach cuts out many middlemen in the traditional payment process. The result is lower fees, faster settlements, and simpler operations for businesses.

This direct approach cuts out many middlemen in the traditional payment process. The result is lower fees, faster settlements, and simpler operations for businesses.

The Traditional Payment "Layer Cake"

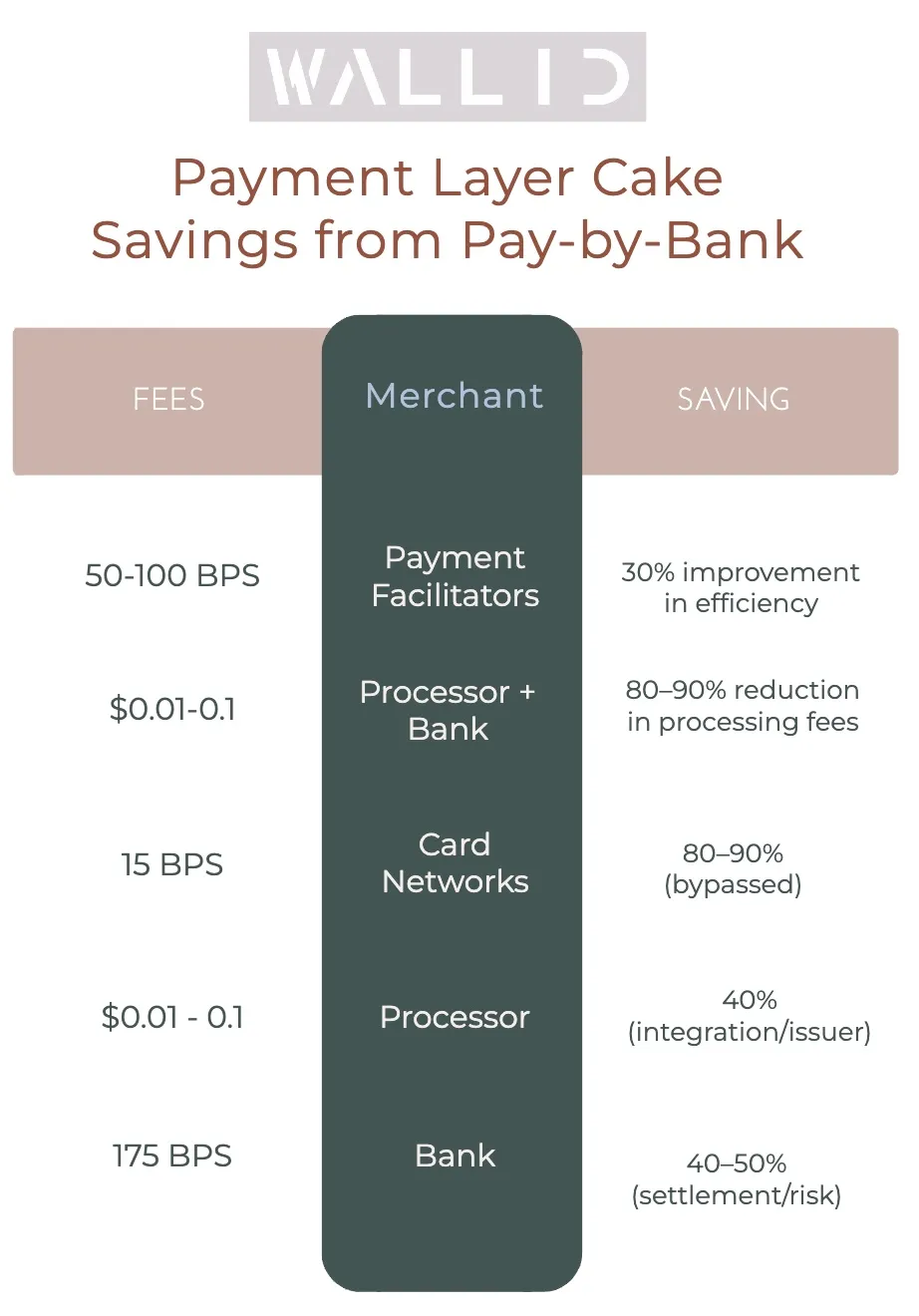

To see how Pay-by-Bank saves money, let's look at how regular payments work. The usual payment process has many steps, kind of like layers in a cake:

Each layer adds costs, time delays, and complexity. Let's see how Pay-by-Bank simplifies each of these layers.

- Payment initiation and authentication

- Processing and clearing

- Settlement and reconciliation

- Risk and fraud management

- Integration and infrastructure

Each layer adds costs, time delays, and complexity. Let's see how Pay-by-Bank simplifies each of these layers.

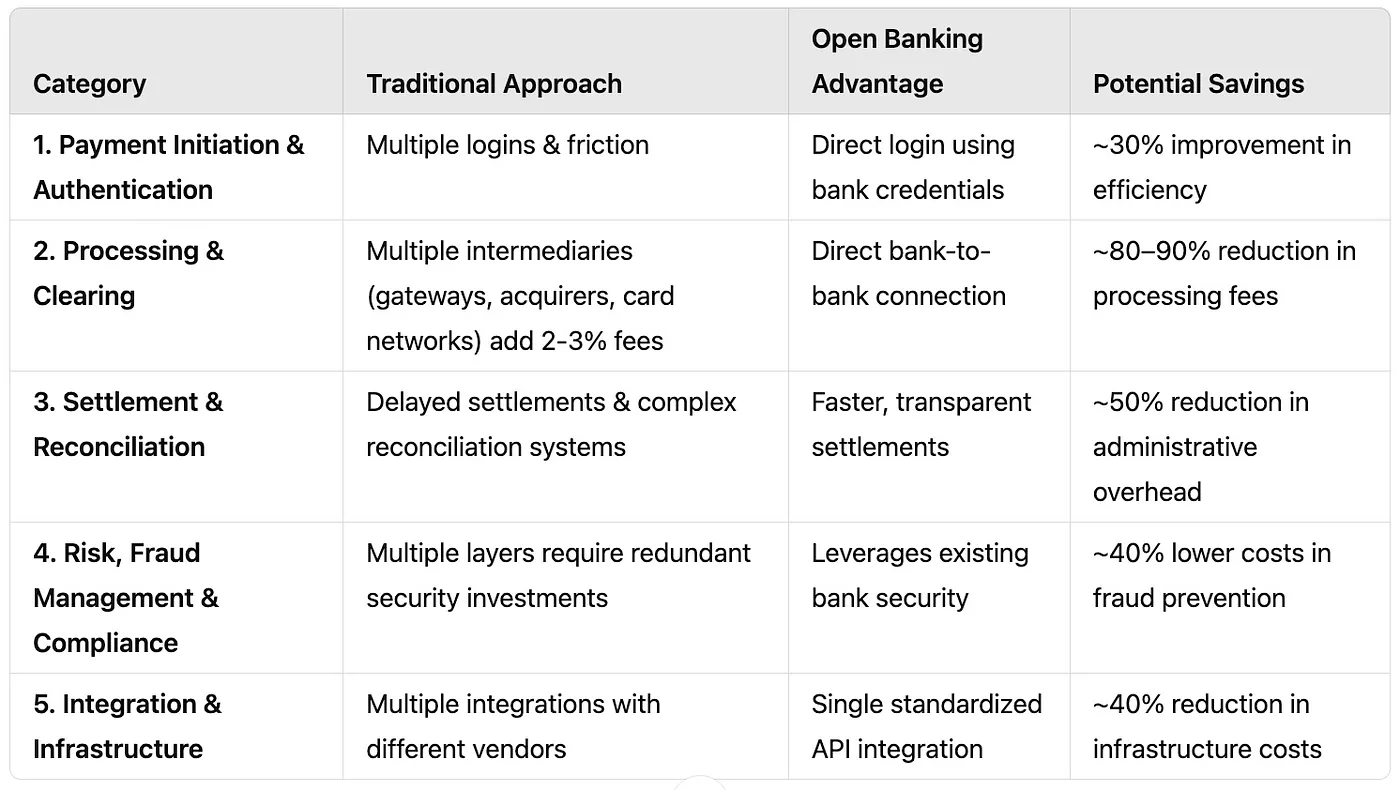

Layer 1: Simpler Payment Initiation and Authentication

The Old Way:

Traditional payment methods need extra steps, like entering details and security checks. This can slow down the process and sometimes customers leave without completing their purchase.

The Pay-by-Bank Way:

With Pay-by-Bank, customers simply:

- Select the Pay-by-Bank option

- Log in with their existing bank credentials

- Confirm the payment

This streamlined approach offers about 30% improvement in checkout efficiency. It reduces cart abandonment and increases sales completion rates.

Layer 2: Direct Processing and Clearing

The Old Way:

When you use traditional payment methods, a lot of different companies are involved. You've got payment gateways, banks that handle the money coming in, card networks like Visa and MasterCard, and the banks that give out the cards. Each of these groups takes a little bit of money from the sale. All those little fees together usually add up to about 2 or 3 percent of what you're paying.

The Pay-by-Bank Way:

Pay-by-Bank creates a direct bank-to-bank connection. This approach bypasses card networks and other intermediaries.

The result? An impressive 80-90% reduction in processing fees. For a business processing millions in transactions, this represents enormous savings.

Layer 3: Faster Settlement and Reconciliation

Let's break down the differences between traditional payment methods and the newer "pay-by-bank" approach.

The Old Way (Traditional Payments):

Some payment methods take longer to process, and businesses may have to wait days to receive their money. Keeping track of payments can also be a bit tricky due to different systems.

The Pay-by-Bank Way (Direct Bank Connections):

Using direct bank connections makes things much easier. Payments happen faster and are clearer, so businesses know exactly what's going on. Keeping track of payments becomes simpler, and there's less paperwork to do. This can cut down on paperwork costs by about half. Plus, businesses get their money faster, which helps their cash flow.

Layer 4: Enhanced Security with Lower Costs

Some payment methods need extra security and fraud protection, which can add to costs. Businesses also have to follow different rules, which takes time and effort. Plus, payments are slow, and keeping track of them is hard. Pay-by-bank is simpler. It uses the bank's security, which saves money on fraud protection (around 40% less). Payments are faster, tracking is easier, and there's less paperwork, saving about 50% on those costs.

Layer 5: Simplified Integration and Infrastructure

Businesses using multiple payment methods may have to manage different systems, updates, and rules. This can take extra time and effort.

One simple connection can link to lots of banks, make payments work the same way every time, and easily change when rules change. This makes the tech simpler, cuts costs for the payment system by about 40%, and makes it easier to update later.

Real Business Benefits of Pay-by-Bank

The combined savings from all layers of the payment process make Pay-by-Bank highly attractive for businesses of all sizes:

- Direct Cost Savings: Reduced transaction fees mean higher profit margins on every sale.

- Improved Cash Flow: Faster settlements give businesses quicker access to their money.

- Lower Operational Costs: Simpler reconciliation and fewer chargebacks reduce administrative work.

- Enhanced Security: Bank-level security measures protect both businesses and customers.

- Better Customer Experience: A streamlined checkout process leads to higher conversion rates.

Implementing Pay-by-Bank in Your Business

Adopting Pay-by-Bank is becoming increasingly straightforward:

- Choose a Provider: Select an open banking payment provider that supports the banks your customers use.

- Single Integration: Implement one API connection instead of multiple payment systems.

- Customer Education: Explain the benefits to your customers - increased security, convenience, and speed.

- Monitor Performance: Track the impact on transaction costs, completion rates, and customer satisfaction.

Conclusion

Pay-by-bank is making payments easier and faster. It helps businesses save on fees, get payments quicker, and manage everything more smoothly. However, credit cards and other payment methods are still useful in many situations, and banks cannot fully replace them in every case. Each method has its own benefits, depending on the business and customer needs.

As open banking grows, pay-by-bank is set to become a standard payment choice. Businesses adopting it early will benefit from cost reductions and improved customer satisfaction, giving them a competitive advantage.

Wallid's Vision

"AI personalized checkout is the future of e-commerce," says Ilya Mikin, CEO of Wallid.co. "By integrating open banking data and AI, Wallid is committed to empowering retailers with personalized, secure, and cost-effective solutions to meet the evolving demands of global consumers."

About Wallid

Wallid is a London-based leader in dynamic checkout and open banking solutions for e-commerce. The company helps retailers boost sales with personalized, secure, and seamless payment experiences. Using AI and innovative technologies, Wallid transforms online shopping by reducing cart abandonment and enhancing customer satisfaction.