Here are some ways in which open banking integration can offer better options:

Direct Bank-to-Bank Transfers

With open banking, customers can make direct bank-to-bank transfers without the need for intermediaries like PayPal. This can result in faster transactions and lower fees for both merchants and customers.

Real-Time Payment Confirmation

Open banking allows for real-time payment confirmation, which means that merchants can receive immediate notification of successful payments, leading to faster order processing and fulfillment.

Enhanced Security

Open banking utilizes strong authentication protocols and secure data sharing mechanisms, making transactions more secure compared to traditional payment methods. Customers can authorize payments directly from their bank accounts, reducing the risk of fraud.

Lower Transaction Costs

By bypassing traditional payment gateways and intermediaries, open banking can reduce transaction costs for merchants, leading to potential cost savings that can be passed on to customers in the form of lower prices or discounts.

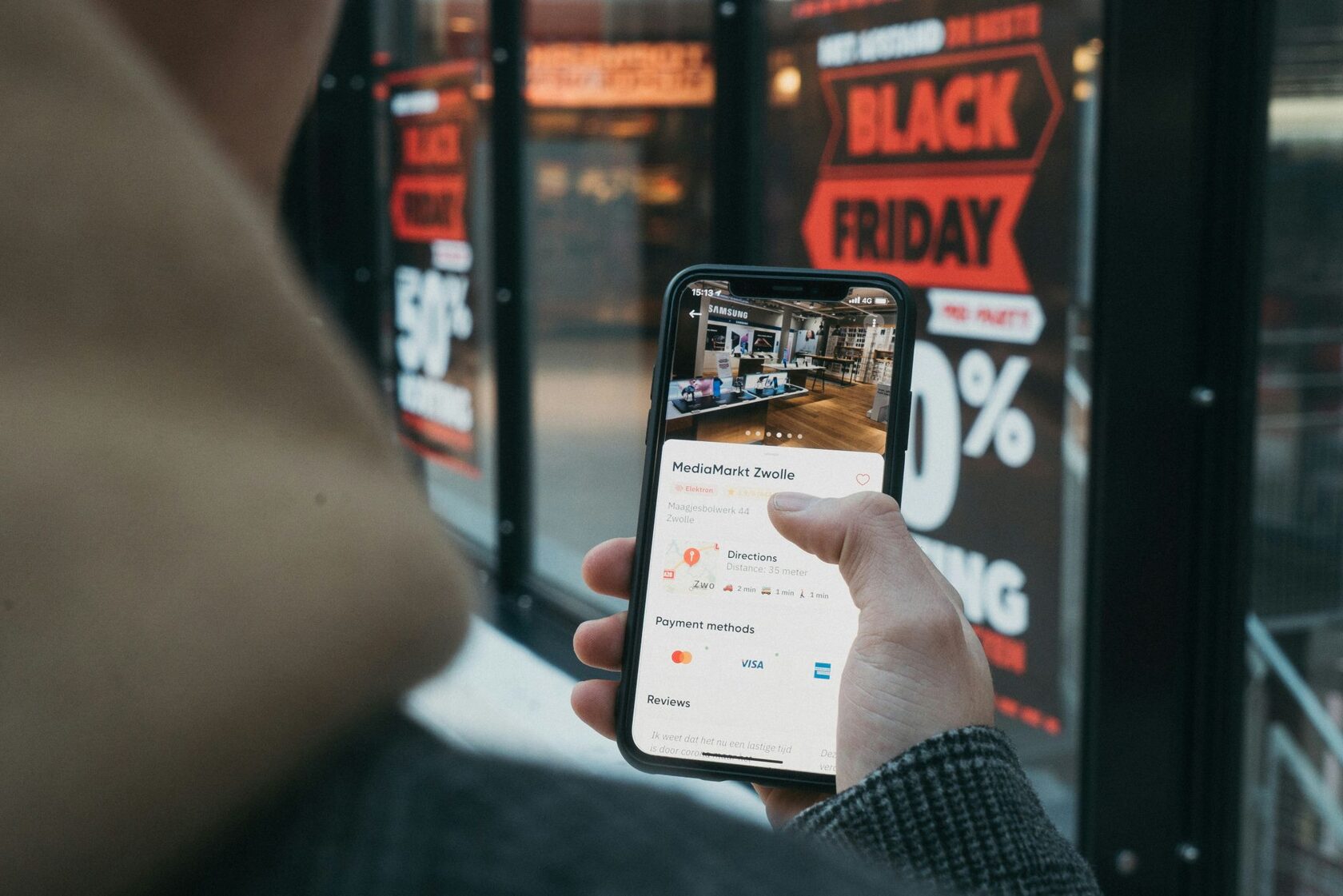

Seamless Checkout Experience

Integration of open banking with e-commerce platforms can streamline the checkout process by eliminating the need for customers to enter payment details manually. Customers can simply select their bank account for payment, authenticate the transaction, and complete the purchase quickly and easily.

Personalized Offers and Recommendations

Open banking allows for the sharing of customer data between banks and e-commerce platforms, enabling merchants to offer personalized product recommendations, discounts, and promotions based on a customer's financial behavior and preferences.

Integration with Budgeting and Financial Management Tools

Open banking integration with e-commerce platforms can provide customers with access to budgeting and financial management tools that help them track their spending, set savings goals, and make informed purchasing decisions.

Overall, the integration of open banking with e-commerce platforms offers a more seamless, secure, and personalized payment experience compared to traditional methods, enhancing customer satisfaction and driving greater efficiency for merchants.