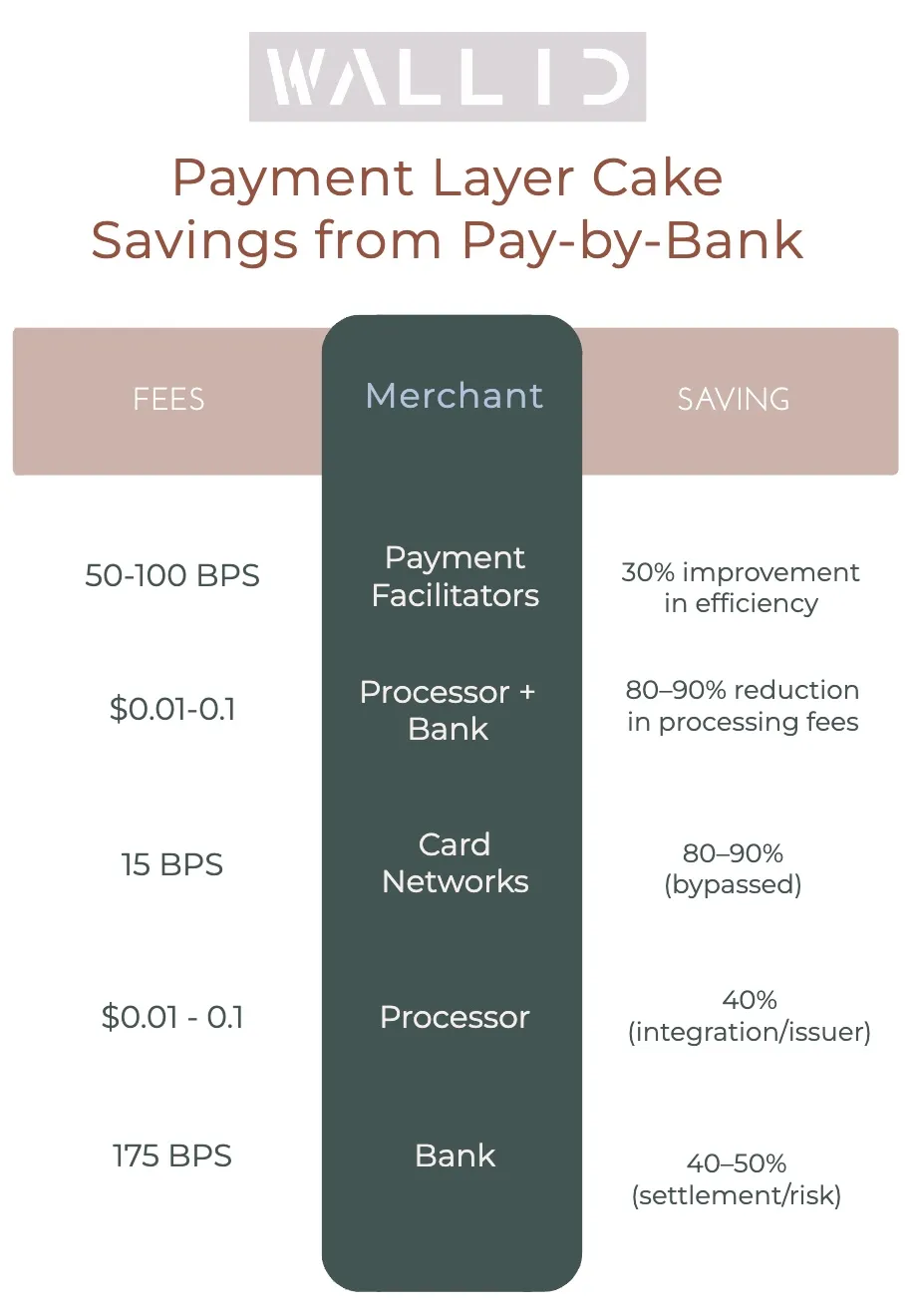

Pay‐by‐Bank leverages open banking APIs to fundamentally reshape the traditional payment “layer cake” by streamlining processes and cutting out unnecessary intermediaries. Here’s a detailed breakdown of how it disrupts each layer and delivers cost savings:

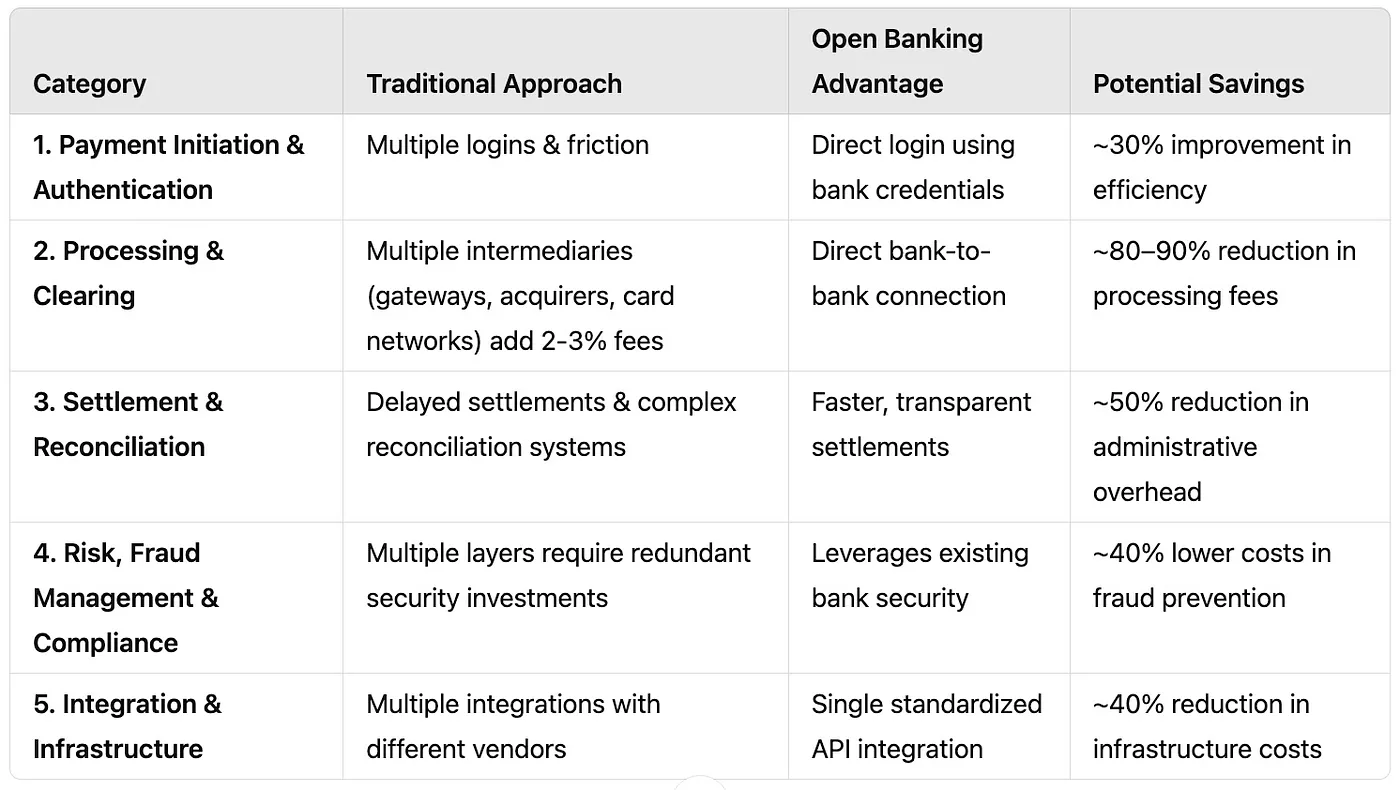

1. Payment Initiation and Authentication

• Traditional Model:

In a typical credit or PayPal transaction, customers must enter card details or log into a separate payment account. This involves additional authentication layers that are both time‐consuming and prone to friction.

• Open Banking Disruption:

With pay‐by‐bank, the payment is initiated directly through the customer’s bank using existing online banking credentials. This leverages the bank’s robust security protocols, eliminating the need for a third‐party payment account and reducing steps in the checkout process.

• Savings:

Fewer authentication steps mean lower costs associated with maintaining multiple secure login systems and reduced risk of abandoned carts due to complex checkout flows.

In a typical credit or PayPal transaction, customers must enter card details or log into a separate payment account. This involves additional authentication layers that are both time‐consuming and prone to friction.

• Open Banking Disruption:

With pay‐by‐bank, the payment is initiated directly through the customer’s bank using existing online banking credentials. This leverages the bank’s robust security protocols, eliminating the need for a third‐party payment account and reducing steps in the checkout process.

• Savings:

Fewer authentication steps mean lower costs associated with maintaining multiple secure login systems and reduced risk of abandoned carts due to complex checkout flows.

2. Processing and Clearing

• Traditional Model:

The conventional payment process involves a cascade of intermediaries: payment gateways, acquirers, card networks (Visa, MasterCard), and issuing banks. Each adds its own fee (often totaling around 2–3% of the transaction value) and latency.

• Open Banking Disruption:

Open banking enables a direct bank-to-bank connection where the customer’s bank communicates directly with the merchant’s bank. This bypasses several layers, including costly card network fees and intermediary processors.

• Savings:

By eliminating or minimizing the need for these intermediaries, businesses can save significant amounts on transaction fees, which directly improves their margins.

The conventional payment process involves a cascade of intermediaries: payment gateways, acquirers, card networks (Visa, MasterCard), and issuing banks. Each adds its own fee (often totaling around 2–3% of the transaction value) and latency.

• Open Banking Disruption:

Open banking enables a direct bank-to-bank connection where the customer’s bank communicates directly with the merchant’s bank. This bypasses several layers, including costly card network fees and intermediary processors.

• Savings:

By eliminating or minimizing the need for these intermediaries, businesses can save significant amounts on transaction fees, which directly improves their margins.

3. Settlement and Reconciliation

• Traditional Model:

In a layered payment system, the clearing and settlement process involves multiple parties that can delay funds and complicate reconciliation. Each intermediary requires additional systems to track and settle transactions accurately.

• Open Banking Disruption:

With a direct connection between banks, transactions settle more quickly and transparently. The banks’ existing infrastructures handle settlement, streamlining reconciliation.

• Savings:

Faster settlements improve cash flow for businesses, and simplified reconciliation reduces administrative overhead and the potential for errors.

In a layered payment system, the clearing and settlement process involves multiple parties that can delay funds and complicate reconciliation. Each intermediary requires additional systems to track and settle transactions accurately.

• Open Banking Disruption:

With a direct connection between banks, transactions settle more quickly and transparently. The banks’ existing infrastructures handle settlement, streamlining reconciliation.

• Savings:

Faster settlements improve cash flow for businesses, and simplified reconciliation reduces administrative overhead and the potential for errors.

4. Risk, Fraud Management, and Compliance

• Traditional Model:

Multiple layers not only add cost but also increase vulnerability to fraud, requiring additional investments in fraud prevention and compliance mechanisms.

• Open Banking Disruption:

Banks already invest heavily in secure authentication and fraud detection. By using open banking, merchants tap into these established systems, reducing the need for extra layers of security.

• Savings:

Lower fraud risk and streamlined compliance processes translate into reduced costs for fraud prevention, fewer chargebacks, and less administrative burden in monitoring transactions.

Multiple layers not only add cost but also increase vulnerability to fraud, requiring additional investments in fraud prevention and compliance mechanisms.

• Open Banking Disruption:

Banks already invest heavily in secure authentication and fraud detection. By using open banking, merchants tap into these established systems, reducing the need for extra layers of security.

• Savings:

Lower fraud risk and streamlined compliance processes translate into reduced costs for fraud prevention, fewer chargebacks, and less administrative burden in monitoring transactions.

5. Integration and Infrastructure Costs

• Traditional Model:

Implementing and maintaining a payment infrastructure that interfaces with several payment providers can be complex and expensive.

• Open Banking Disruption:

Pay-by-bank solutions typically require a single integration with an open banking provider, which can then access multiple banks through standardized APIs.

• Savings:

This consolidation minimizes development and maintenance costs while ensuring scalability and adaptability as banking regulations evolve.

Implementing and maintaining a payment infrastructure that interfaces with several payment providers can be complex and expensive.

• Open Banking Disruption:

Pay-by-bank solutions typically require a single integration with an open banking provider, which can then access multiple banks through standardized APIs.

• Savings:

This consolidation minimizes development and maintenance costs while ensuring scalability and adaptability as banking regulations evolve.

Payment Layer Cake Savings Overview

Conclusion

By leveraging open banking, pay-by-bank solutions cut through the traditional payment layer cake — eliminating multiple intermediaries, reducing transaction fees, accelerating settlement times, and simplifying compliance. This not only enhances the customer experience with a smoother, faster checkout but also delivers significant cost savings across every level of the payment process, positioning businesses to operate more efficiently in a competitive digital marketplace.