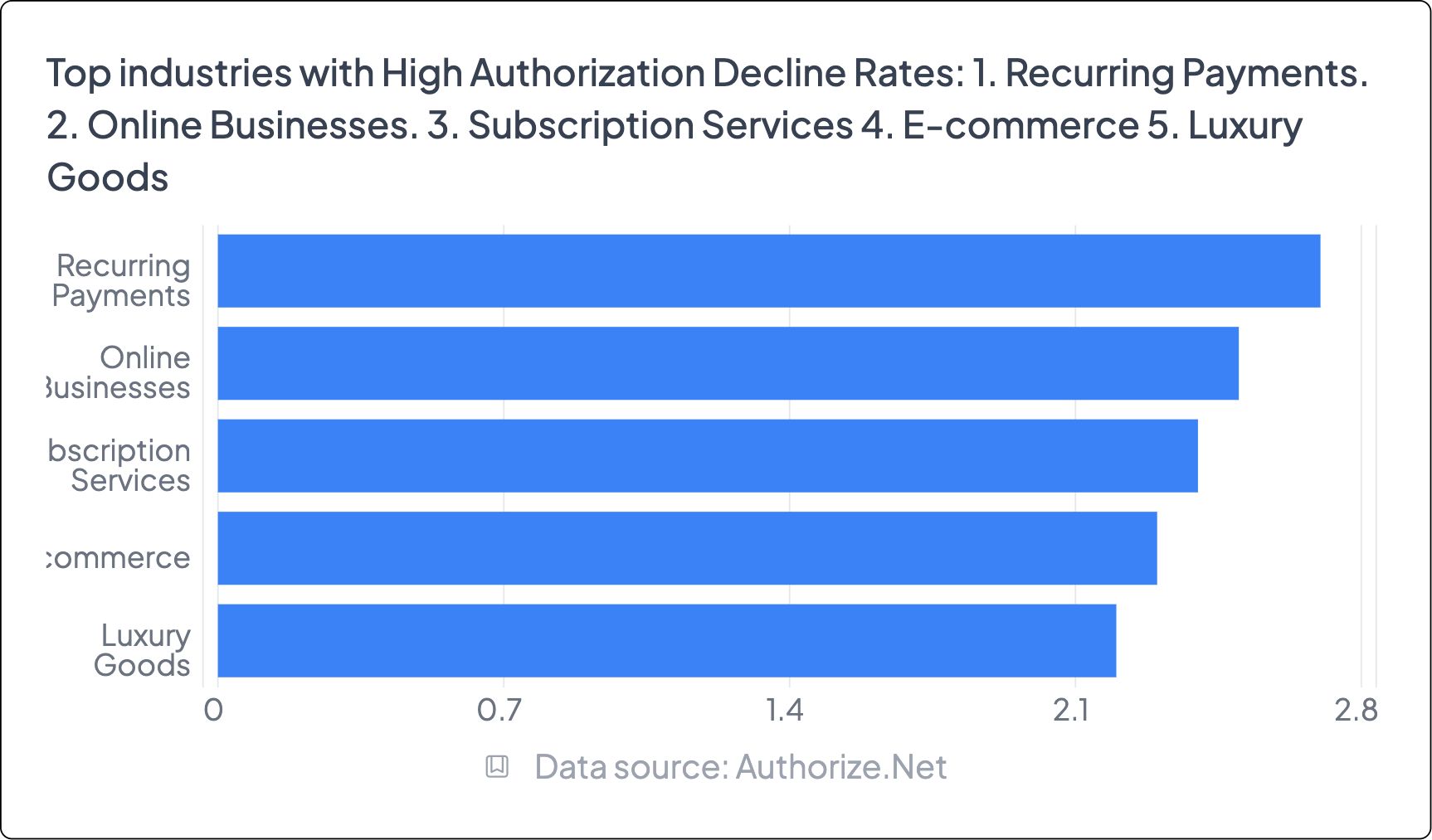

Recurring Payments Face Declines of 15–30%

Approximately 15% of credit card payments tied to recurring billing are being declined, and in some sectors, this number exceeds 30%. These failed transactions can significantly affect monthly revenue for subscription-based models.

Online Businesses Struggle with Fraud and Incorrect Card Data

Online merchants face common challenges like incorrect card information, suspicious activity, and higher exposure to fraudulent transactions, all of which contribute to elevated authorization decline rates.

Subscription Services See 15% Average Decline Rates

Similar to recurring billing, subscription services report high failure rates—around 15% on average. These declines can disrupt customer experience and trigger involuntary churn.

E-Commerce Payments Declined at Alarming Rates

The ecommerce industry is seeing authorization declines as high as 17%. From high-volume transactions to mobile-driven purchases, declines lead to cart abandonment and revenue loss.

Luxury Goods Transactions at Higher Risk of Decline

Luxury retailers often experience more declines due to high ticket sizes and fraud detection systems flagging legitimate purchases as suspicious.

What Causes Payment Authorization Declines?

The most common causes include:

- Outdated card information

- Insufficient funds

- Transaction flagged as suspicious

- Mismatch in customer data

How to Improve Approval Rates and Reduce Declines

To reduce authorization issues, businesses should:

- Partner with reliable payment processors

- Offer alternative payment methods like Pay by Bank

- Implement real-time fraud screening

- Keep cardholder data up-to-date with smart retry logic

Final Thought: Addressing Declines to Boost Revenue

If your business operates in recurring payments, online services, subscriptions, ecommerce, or luxury retail, it’s critical to identify and address decline issues proactively. Improving payment flows and approval rates leads to higher customer satisfaction, reduced churn, and stronger financial outcomes.

It is essential for businesses to identify the reasons behind these failed transactions, such as insufficient funds, outdated card details, or suspicious activity. Collaborating with reliable payment partners can help improve approval rates and reduce declines, leading to increased customer satisfaction and revenue.

If your business operates in recurring payments, online services, subscriptions, e-commerce, or luxury goods, it is crucial to address authorization decline issues. By addressing these challenges and partnering with reputable payment providers, businesses can enhance transaction approval rates and drive financial success.

If your business operates in recurring payments, online services, subscriptions, e-commerce, or luxury goods, it is crucial to address authorization decline issues. By addressing these challenges and partnering with reputable payment providers, businesses can enhance transaction approval rates and drive financial success.