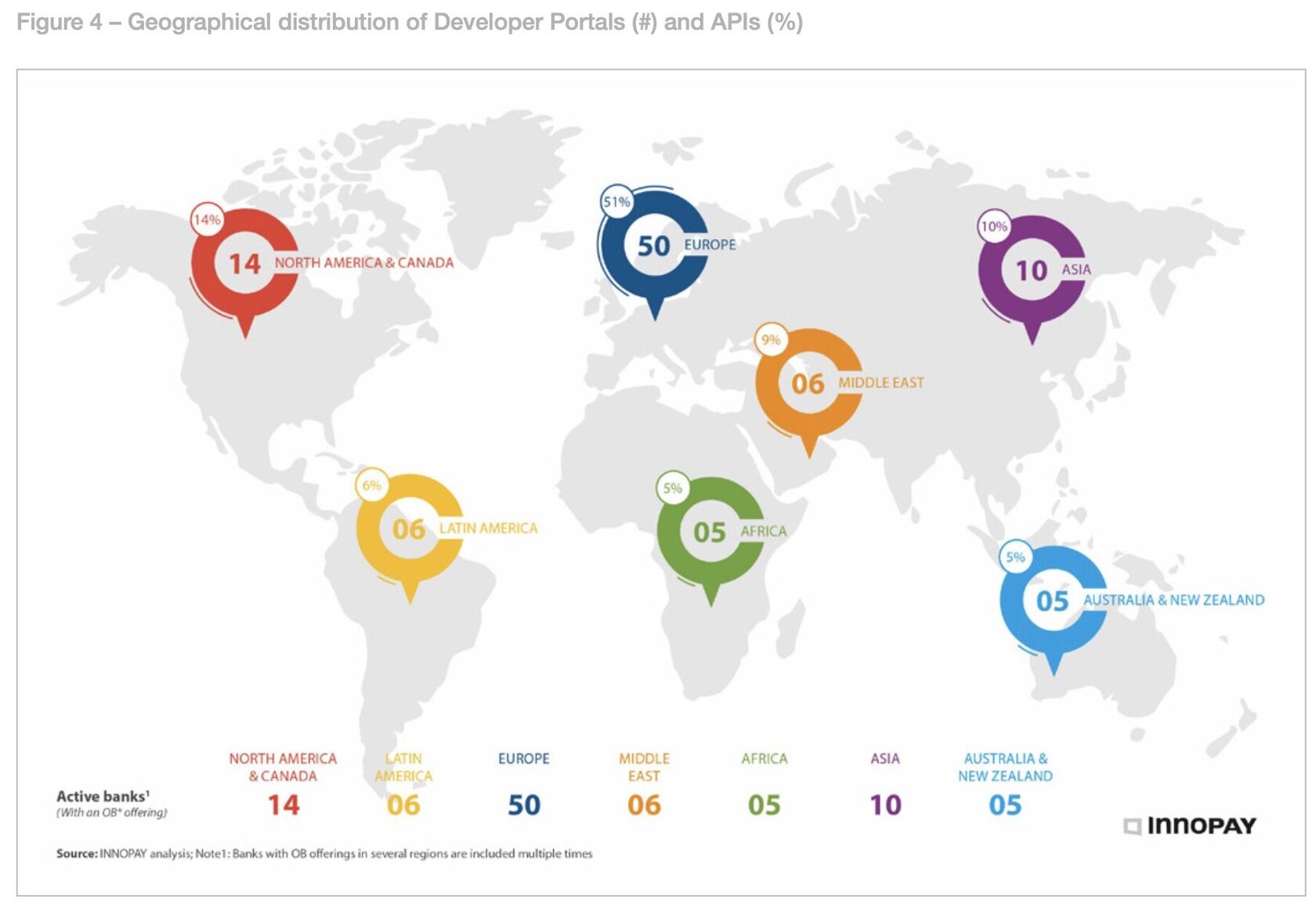

Global Distribution of Open Banking Developer Portals

Europe continues to lead the open banking landscape, accounting for 51% of all active open banking (OB) developer portals globally, according to Innopay data. North America and Canada have now climbed to second place, making up 14% of developer portals with OB offerings. This marks a notable shift in global dynamics, as US-based institutions begin to catch up.

US Banks Are Closing the Gap in Open Banking API Development

While US banks were previously considered laggards, the past 12 months have seen significant strides. Though Europe still holds the majority share of available APIs, the US is emerging as a powerful second contender. Citi Bank now ranks among the Masters in Openness, and US Bank and Wells Fargo have notably expanded their API catalogues and improved developer experience.

Major US Players Expanding API Scope and Developer Experience

Banks like Cross River Bank and Capital One stand out for their above-average performance in functional scope and developer support, respectively. Even traditional powerhouses such as Goldman Sachs, JPMorgan, and Chase have started revealing their open banking offerings, although access remains limited and inconsistent.

Investment and FX APIs Give US Open Banking a Competitive Edge

One key differentiator for US banks is their broad range of Investment and Foreign Exchange APIs. These enable real-time access to investment data on stocks, bonds, exchange rates, and even direct trading. Unlike Europe’s regulation-first approach, US open banking is primarily driven by industry innovation, giving rise to more diverse and commercially focused API portfolios.

From Regulation to Innovation: The Industry-Led Approach in the US

US financial institutions are leveraging open banking APIs not only for compliance but as a strategic business tool. This innovation-led model promotes faster iteration, tailored developer experiences, and differentiated value propositions — from embedded finance to wealth management integrations.